The 2018 tax season is over and now we need to plan for 2019. While tax laws are important (refer to the April 7, 2019 blog for more information) to help evaluate investment property, some basic math skills will tell you what type of return you are going to get on your investment property. In 2016, 37% of all homes sold in the US were purchased for investment purposes. The homeownership rate in 2016 was the lowest in 50 years, as renting has been increasingly the more frequent choice. You can purchase investment property for appreciable purposes or for its monthly cash flow.

If appreciation is your mode of investing, you will have to search out regions of the country that are seeing a rapid rate of appreciation. For example, in Austin, TX in 2010, they averaged, 8.9% yearly appreciation over 20 years. During a short time frame the average appreciation was 16%. As the National Association of Realtors reported, over a 36-year period from 1968 to 2004, the average price increase in the USA has been 6.4%. Investing for appreciable purposes to reap a high rate of return would be like trying to pick that one stock that is going to explode, a bit riskier. Investors today need to be scrupulous and know that investing in property is a long-term investment. We are investing for our retirement and our kids’ future.

If cash flow is something that sounds less risky, grab a paper and pencil to determine your next investment. You will, commonly, hear of the 1% or 2% rule in real estate, which essentially means the property should cash flow, every month, up to 1% of the purchase price of that property. For example, purchase a single-family home for $150,000 x 1% = $1500 rent income per month. While this is a very simple approach, you may want to check the areas you are investing and see if the size of the home, location, etc. will warrant $1500 rent per month. Housing prices are not always a direct correlation to the rental market. A more detailed calculation would be the Gross Rent Multiplier which is a ratio between the purchase price and the annual rent income. For example, the single-family home for $150,000 that returns $1200 in monthly income is calculated as: Monthly rent $1200 x 12 (months) = $14,400 annualized rent income. $150,000 / $14,400 = 10.42 Gross Rent Multiplier. The result, 10.42, tells you it will take over 10 years to pay for itself in gross rent received. This calculation does not account for taxes, insurance, utilities etc. Also, the calculations are based on purchasing the property with cash and does not account for mortgage interest. Let’s take this one step further and use operating expenses and vacancy. While it is in your best interest to keep the property rented 100% of the time, there are times when it will not be occupied.

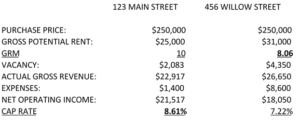

Let’s take a closer look at our investment options. We will compare 2 properties with the same purchase price. One property receives $6000 more in annual rent income but also sees a higher vacancy rate and costs more to operate each year. If we were investing based, solely, on the GRM to determine our investment, then Willow St looks like a great investment. With a $250,000 investment, that property will be paid for with rental income after 8 years while Main St will take 10 years! As we mentioned earlier, Willow has a higher vacancy rate and costs more to operate, so based on those factors, Main St would be the better investment. The Capitalization Rate (Cap Rate) or Return on Investment (ROI) on Willow St is 7.22% vs 8.61% on Main Street. If we based our investment decision on Cap Rate, then Main St would be the better investment. The higher the cap rate or ROI, the better the investment.

What if you don’t have two properties to compare, then what do you compare the Cap Rate to or ROI? Compare it to other long-term investment vehicles. Remember, when comparing, always determine the ROI vs the risk factor.

Long term investing in real estate has always been a secure investment. Seek out a real estate professional who understands investment property.

Call me with questions,

Melissa Zimmermann, EA and Realtor

An Investment You Can Live In